Invest

Sunstone Capital Limited (Sunstone) offers a unique investment opportunity.

Investors can earn dependable returns generated by a portfolio of highly liquid operating assets.

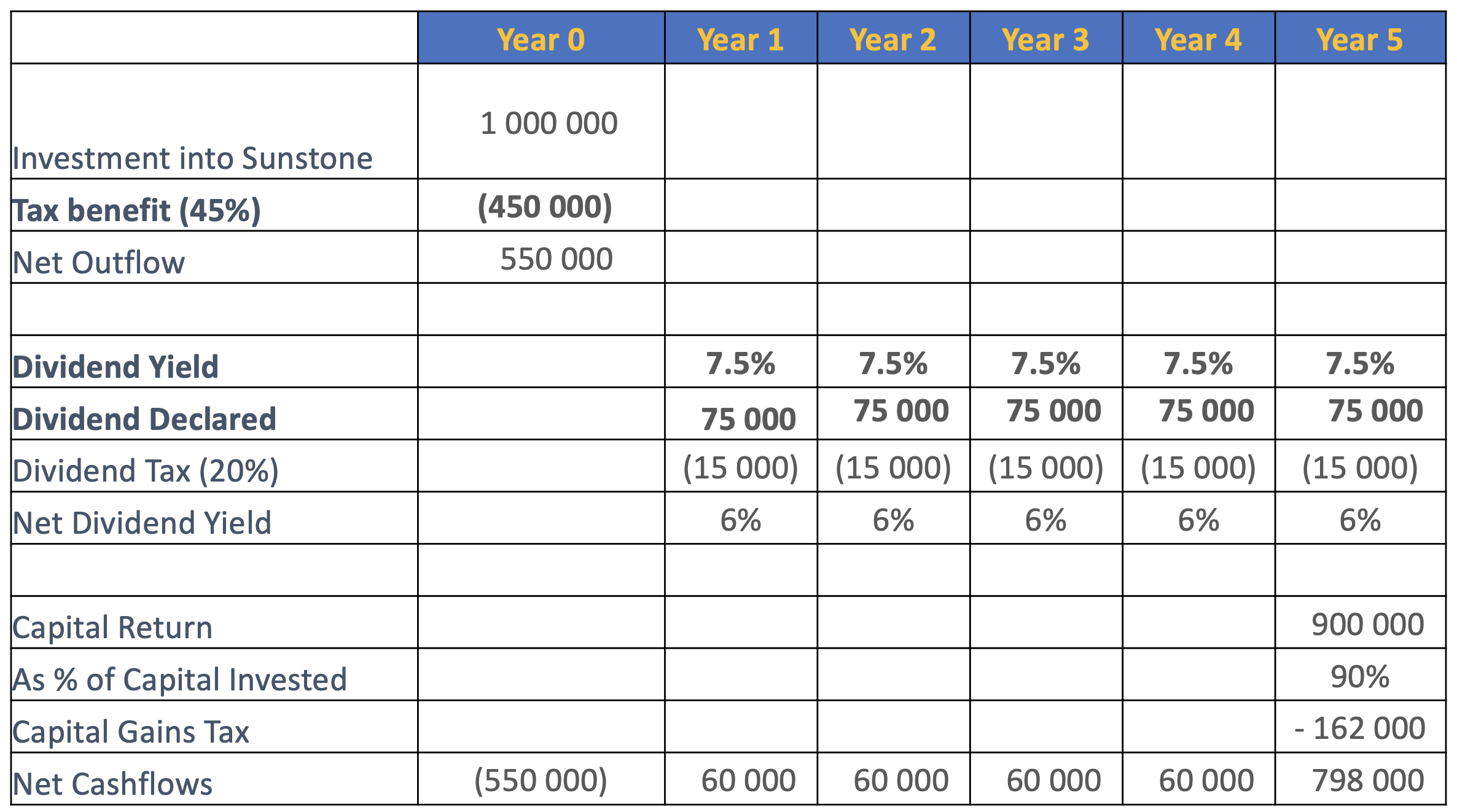

With a a moderate-low risk profile and 6-8% annual dividend yield target, we are able to target 16-18% returns to shareholders who make use of the tax benefits of our fully tax deductible section 12J investment opportunity

Investment highlights

- Secured by asset underpin

- Highly liquid

- Diversified portfolio

- Full deployment of capital

- Fully tax deductible

Targeted Return Profile